How Baton helped pharmacy owners find their “honorable successor” and retire on a high note

Aubree Munar

February 2, 2024 ⋅ 3 min read

About the business

Industry: Pharmacy

Location: Orland Park, IL

Revenue: $5.6M

Size: 0-10 employees

The challenges

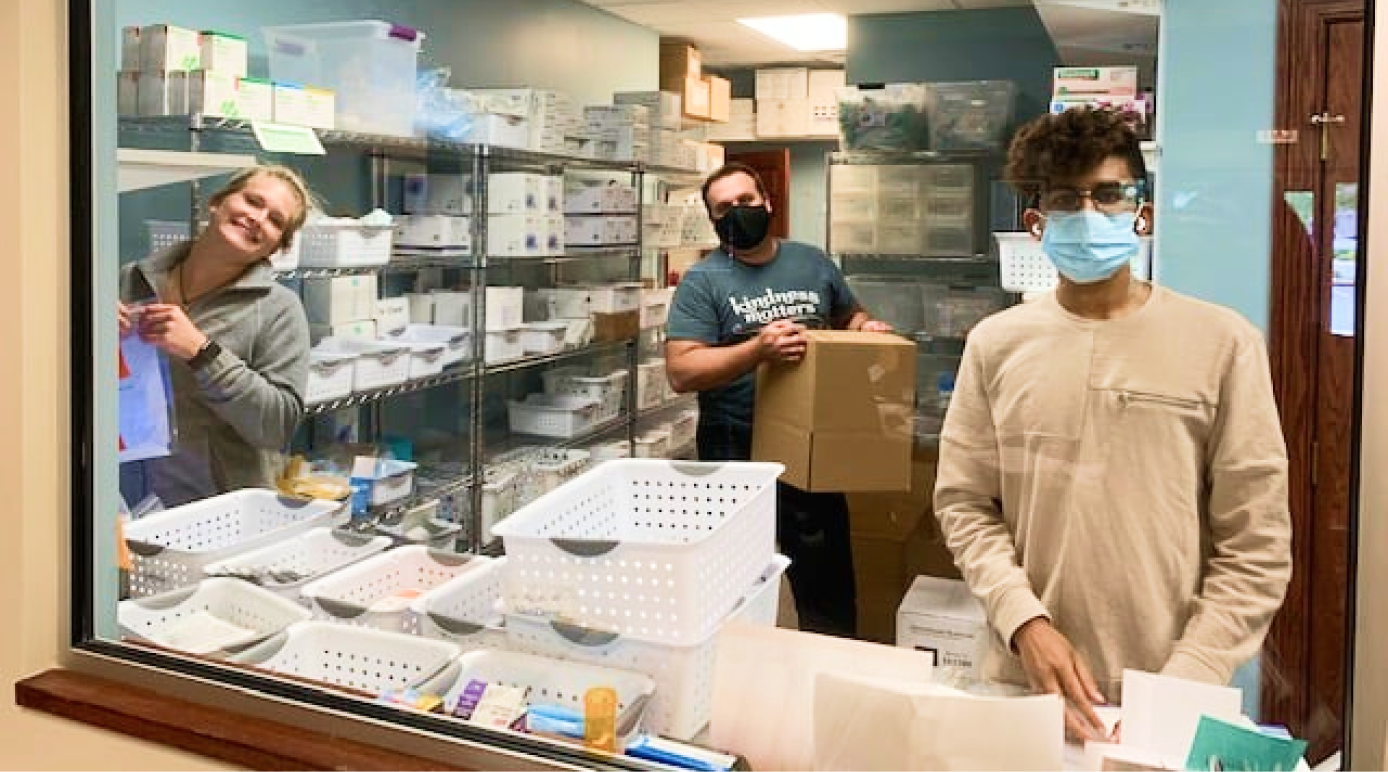

Over 20 years, Hans and Nancy Kuhn had grown ASAP Pharmacy and a loyal stable of employees just outside Chicago. Patients with chronic illnesses relied (and continue to rely) on the specialty pharmacy for personalized care.

When they were ready to retire, the Kuhns hired an M&A advisor they hoped would help them navigate the process. And though the advisor found a buyer for their business, the buyer was an investor who wasn’t invested in honoring the business’s legacy: They were happy to build on the company’s financial success without retaining the mission-critical employees who’d contributed to it.

The Kuhns were determined to retire and secure ASAP’s legacy, including its people.

Why Baton?

When The Kuhns first encountered Paul, their Baton Acquisition Advisor, they were able to get all of their priorities out on the table: In addition to finding a buyer from the industry who would provide continuity, they were looking for someone who’d value the business’s small brick-and-mortar footprint — located in a larger commercial building. Paul was able to leverage his 30+ years of experience to put the right wheels in motion.

From "hello" to close

The Kuhns formally launched their sale with Baton in June of 2023. Here’s what his Baton journey looked like:

The Kuhns received our proprietary, data-backed valuation of ASAP Pharmacy.

Paul presented Hans with a pricing structure tailored to his business and including no upfront payment.

We launched buyer outreach to multiple marketplaces, Baton’s qualified buyer pool, and local competitors, leaving no stone unturned. All potential buyers received calls, texts, and emails.

Within 6 weeks, the business had received interest from 100 buyers, and Baton had to halt their marketing efforts due to the overwhelming response.

By July, Paul had presented Hans with 7 LOIs from prospective buyers in the healthcare and pharma industries.

The Kuhns appreciated that Paul was “intuitive” to their concerns and feelings.

Paul and Baton were happy to help The Kuhns find a buyer they were “very happy with,” and who met all of their criteria:

Industry experience

Willing to honor ASAP’s legacy

Interested in purchasing the business’s real estate

By January, the paperwork was complete on the sale of the business, and ASAP had a new owner.

Baton collected less than 1/3 of the fees that a traditional broker would have, allowing The Kuhns to exit with greater proceeds from their life’s work.

The Kuhns are now retired, and their former employees continue to provide an important service to the community alongside ASAP’s “honorable successor.”

“The whole process was painless and actually not stressful. Why? Paul brought us through the process, giving us facts, and limited advice where it was our decision, and not a pressure sale. He always had our best interest in mind."

- Hans Kuhn, Former Owner, ASAP Pharmacy

Thinking about selling your business? Learn about our process and your business’s worth today.